CDARS Deposit Placement Agreement 2007-2025 free printable template

Show details

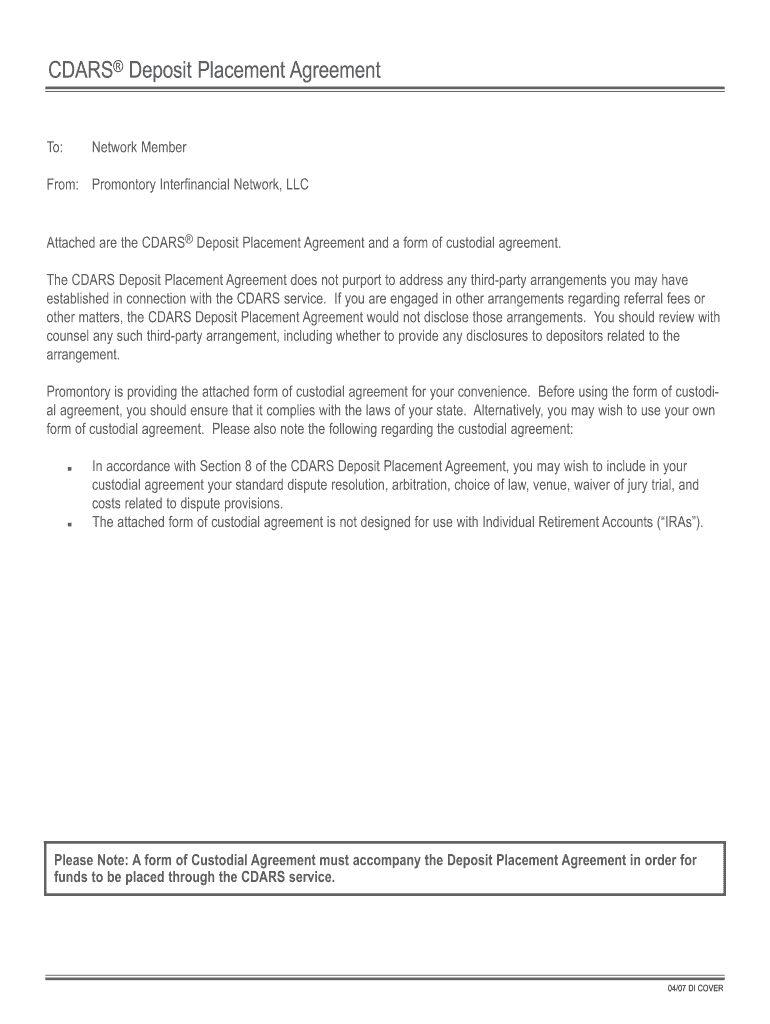

CDARS Deposit Placement Agreement To Network Member From Promontory Interfinancial Network LLC Attached are the CDARS Deposit Placement Agreement and a form of custodial agreement. Neither we Promontory nor the insured placement of funds that are not eligible for deposit insurance. Please Note A form of Custodial Agreement must accompany the Deposit Placement Agreement in order for funds to be placed through the CDARS service. The CDARS Deposit Placement Agreement does not purport to address...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign deposit placement

Edit your deposit placement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit placement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deposit placement online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deposit placement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deposit placement

How to fill out CDARS Deposit Placement Agreement

01

Obtain the CDARS Deposit Placement Agreement form from your financial institution.

02

Review the terms and conditions of the agreement carefully, ensuring you understand how CDARS works.

03

Fill out your personal and account information in the designated sections of the form.

04

Specify the amount you wish to deposit and any preferences or instructions you have for the placement.

05

Sign and date the agreement to authorize the placement of your funds.

06

Submit the completed agreement to your financial institution for processing.

Who needs CDARS Deposit Placement Agreement?

01

Individuals or businesses looking to invest large sums while maintaining FDIC insurance limits.

02

Clients of participating banks that wish to diversify their deposits across multiple institutions.

03

Investors seeking a low-risk cash management solution.

Fill

form

: Try Risk Free

People Also Ask about

What is a deposit placement?

--The term "deposit placement network" means a network in which an insured depository institution participates, together with other insured depository institutions, for the processing and receipt of reciprocal deposits.

What is the FDIC assessment rate for 2023?

Progressively lower assessment rate schedules will take effect when the reserve ratio reaches 2 percent, and again when it reaches 2.5 percent. The FDIC also concurrently maintained the DRR for the DIF at 2 percent for 2023.

Why do banks use reciprocal deposits?

Reciprocal deposits are popular because they tend to be associated with multi-million-dollar depositors, enabling banks to attract deposits in large chunks with lower acquisition and maintenance costs as costs tend to be spread over much larger deposit amounts.

What are listing service deposits?

A "listing service" is a company that compiles information about the interest rates offered. on certificates of deposit ("CDs") by insured depository institutions.

What is deposit assessment?

The Deposit Insurance Fund (DIF) is funded mainly through quarterly assessments on insured banks. A bank's assessment is calculated by multiplying its assessment rate by its assessment base. A bank's assessment base and assessment rate are determined and paid each quarter.

How much is the Deposit Insurance Fund?

Deposit insurance is the government's guarantee that an account holder's money at an insured bank is safe up to a certain amount, currently $250,000 per account. Deposit insurance is provided by the Federal Deposit Insurance Corporation (FDIC), a government agency that collects fees – insurance premiums – from banks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit deposit placement from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your deposit placement into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete deposit placement online?

With pdfFiller, you may easily complete and sign deposit placement online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit deposit placement online?

The editing procedure is simple with pdfFiller. Open your deposit placement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is CDARS Deposit Placement Agreement?

The CDARS Deposit Placement Agreement is a contractual agreement that allows depositors to place large sums of money into a network of banks while ensuring that their deposits are fully insured by the FDIC, up to applicable limits.

Who is required to file CDARS Deposit Placement Agreement?

Financial institutions that participate in the CDARS network and facilitate the placement of large deposits on behalf of their clients are required to file the CDARS Deposit Placement Agreement.

How to fill out CDARS Deposit Placement Agreement?

To fill out a CDARS Deposit Placement Agreement, one must provide details such as the depositor's information, the amount to be deposited, and the terms of the agreement, ensuring all sections of the form are completed accurately.

What is the purpose of CDARS Deposit Placement Agreement?

The purpose of the CDARS Deposit Placement Agreement is to provide a structured way for individuals or businesses to secure large deposits while taking advantage of FDIC insurance and to facilitate the distribution of those deposits across multiple banks.

What information must be reported on CDARS Deposit Placement Agreement?

The information that must be reported on a CDARS Deposit Placement Agreement includes the depositor's name and contact information, the amount of the deposit, and the specified maturity dates for the CDs placed through CDARS.

Fill out your deposit placement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit Placement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.